The Rise of OTT

How over-the-top (OTT) service providers are impacting the telecommunications sector

The old business model for telecommunication operators involves selling voice minutes and messaging plus a few extras. This is rapidly diminishing and being replaced by the sale of broadband connectivity. But this allows the Internet giants and others to operate telecommunication services over networks they don’t run or pay for. What, if anything, should telecommunication operators, regulators and other players do about this?

The rise of OTT

Telecommunication networks originally evolved with the communication services they provide embedded into the network. For example, 2G and 3G mobile communication networks have embedded mechanisms for the transmission of voice calls and for text messaging. Similarly, traditional fixed telephone networks incorporate mechanisms for the routing and transmission of voice calls.

With the uptake of IP-based communication networks, it has been possible to separate service and network layers. Now telecommunication services can be implemented as just one of many applications running over a broadband connection. This has led to the rise of a new class of over-the-top (OTT) service providers offering traditional telecommunication services running over both fixed and mobile networks. These providers operate over the top of the networks they use for delivery and do not normally need to interact with the operator running the network. The original pioneer for voice was Skype, but now there are many others and voice and messaging are frequently combined as in the case of WhatsApp. Telecommunication services are also often provided as part of a larger offering such as with Facebook Messenger and Apple’s FaceTime system.

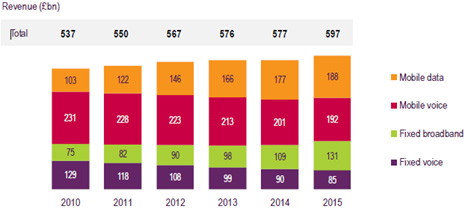

This change has caused network operator revenues to decline from traditional voice and messaging services but to increase from the provision of broadband data services. This is shown in the chart for both mobile and fixed revenues

Ofcom data showing changes in operator revenues for 18 reference countries

It has also caused customer relationships to shift as users begin to have a stronger relationship with OTT providers than with their network operator for voice and messaging services.

OTT telecommunication services have proved popular with users since they are easy to use, provide enhancements such as video calling and are offered free of charge or at low cost. The youth segment was the early driver for growth, but uptake now extends to all segments, including business users. Growth of traffic has been dramatic, especially for international calls where costs are often much lower than for conventional telephony.

What are the implications?

Although attractive to users, OTT telecommunication services have raised concerns with governments, regulators and network operators.

Network operator concerns

Some operators complain they are becoming no more than “bit pipes” for international internet companies offering telecommunication services direct to end-users. Some maintain the resulting reduction in revenues limits the extent to which they can invest in network improvements. Another complaint is that OTT providers avoid obligations imposed on conventional operators such as supporting emergency services and universal service provision.

Against this, there is evidence that reduced revenues from traditional telecommunications services is compensated by broadband connectivity charges and indeed this is shown in the chart above. Also, there is also no real evidence of reduced revenues causing lower investment in networks in countries where OTT is widespread.

Government and regulator concerns

Some governments are concerned that the rise of OTT will lead to lower government income either directly, where operators are state owned, or in the form of taxes. There are also concerns about security since OTT services are more difficult for states to monitor or intercept. Separately, there are concerns about reduced support for emergency services and loss of privacy for users since OTT telecommunication can be less secure than conventional systems.

A counter argument is that OTT leads to a more diverse and competitive telecommunication sector resulting in increased economic growth and prosperity and that this offsets any revenue reductions. It is also argued there are ways to deal with security and privacy concerns and that it is not practical to try and prevent users adopting OTT services since there will always be ways to circumvent any restrictions.

What’s been the reaction?

As a result of these issues, some operators have blocked OTT telecommunication services or introduced throttling to degrade the user experience. These measures are difficult to introduce effectively and, not surprisingly, are unpopular with users. In some markets, competitive pressures have seen operators abandon such measures. Other operators have adopted more constructive approaches and have introduced their own equivalent OTT services or formed partnerships with key OTT providers.

Actions taken by some operators to block or degrade OTT communications traffic have stimulated interest worldwide in network neutrality. Network neutrality is the principle that all network traffic should be treated equally without discrimination. The trend in most developed markets has been to introduce network neutrality, although there is no consensus on how best to do this. However, this is not the case in all countries and some regulators view operators discriminating between different types of traffic as a legitimate competitive response to OTT providers. In a recent development, the new US administration has appointed Ajit Pai to head the FCC – he takes the latter view and regards network neutrality as “a mistake”.

Although approaches to network neutrality differ considerably in developed telecom markets, the general approach had been to accept the arrival of OTT providers and in some cases to welcome the diversity and innovation such providers bring. Where OTT services connect to conventional telecom services (for example a Skype call terminating on a conventional phone line) some countries require providers to comply with obligations such as supporting emergency calls and meeting quality of service requirements. For telecommunication services originated and terminated totally on an OTT basis, it is accepted that regulation is not desirable and/or practical to implement.

The situation is developing countries is generally less positive towards OTT telecommunication providers. In the UAE, for example, only the two licensed operators, Etisalat and Du, are allowed to offer telecommunication services. OTT providers are required to coordinate with these operators if they wish to enter the market; no such collaborations are known to exist. It has been speculated that the large number on expat workers in the country combined with high international call charges mean operators are unenthusiastic to encourage OTT services. In contrast in South Africa, operators are keen to stimulate demand for broadband services and OTT providers are seen as a way of doing this. Hence operators generally welcome OTT providers and are willing to collaborate with them.

India is an interesting developing market. Here some operators have pressed for more regulation of OTT providers and some blocking has taken place. The regulator issued a public consultation paper highlighting the issues and stated they were considering regulating OTT providers. Normally this type of public consultation attracts responses only from market participants and a few other interested parties. But this case it received widespread public interest and some 800,000 responses were received, many pressing for network neutrality to be introduced. This indicates the attractiveness of OTT services to consumers and in response the regulator initiated with another public consultation on introducing network neutrality rather than directly regulating OTT providers.

Our view

The arrival of OTT on the telecommunication scene is a classic case of a sector being disrupted being digital technology. Both fixed and mobile networks evolved to convey only voice communication, but nowadays this is just one of many services being delivered using these networks. Also for some providers, voice calls are just one feature in a much broader offer to the public.

This is a new reality which cannot be stopped and should not be resisted. It is sensible for operators to take a staged approach adapting to the new reality and in some cases government regulation will be needed along the way. Adaptation may involve operators accepting a role as a “bit-pipe” provider and focusing being as good at this as possible. Or it may involve offering either own-brand OTT services or collaborating with Internet companies to create new offerings. In the end, the role of traditional operators will be even more important than before since they have an essential role providing much of the connectivity which at the heart of the digital revolution. As such, operators have the potential to be even more successful in future provided they can navigate from old certainties to the new reality.