5G – New Horizons

The latest 5G specification focuses squarely on new applications beyond traditional telecom – The opportunity is huge, but it won’t be easy

Alan Carr: Director, Mobius Consultants Limited

The third version of the 5G specification is about to be finalised. This version will shift the emphasis from the building blocks of the system, to how it can be applied in a host of new application areas beyond simply providing smartphone connectivity. This is timely since 5G has been a disappointment so far – coverage is limited and it’s not much faster than 4G. In the new version, features have been added targeting a wide range of industry verticals. And, for the first time, satellite communication is included, potentially extending coverage globally. The opportunity is huge but diversifying into many and varied new applications will not be easy and the main obstacles are to do with industry structure rather than technical issues.

What could be?

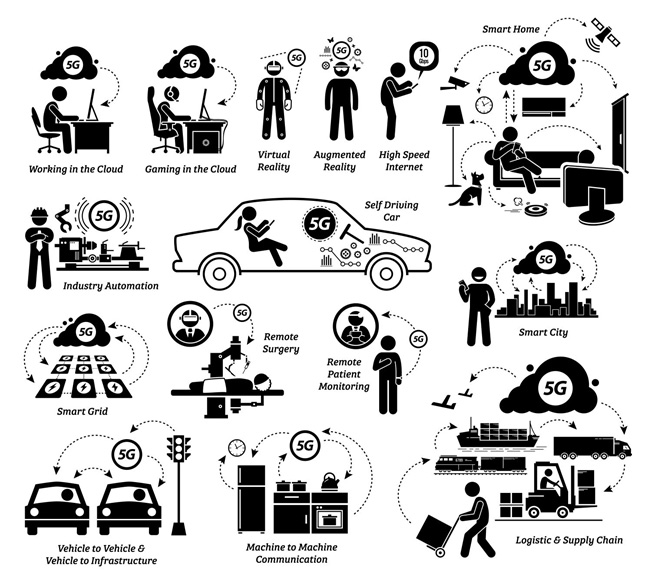

Imagine a factory where sensors and controls are connected wirelessly yet entirely securely, plant can be moved around flexibly, production is geared automatically to individual customer needs, supply chains and transportation are fully integrated, and where the factory may be distributed geographically and/or by function.

Imagine a factory where sensors and controls are connected wirelessly yet entirely securely, plant can be moved around flexibly, production is geared automatically to individual customer needs, supply chains and transportation are fully integrated, and where the factory may be distributed geographically and/or by function.

Or a national ambulance service where ambulances are effectively mobile components of a fully integrated health service, secure broadband communication is available irrespective of location, equipment can be monitored and controlled remotely, and medics have remote access to specialist doctors using Augmented Reality (AR) to deliver the best possible treatment to patients in the field.

Or road vehicles (including self-driving vehicles) able to communicate in real-time with each other and the road infrastructure for accident avoidance and improved traffic flow. Connectivity will also enable vehicle manufacturers to monitor the performance of their vehicles and intervene as needed; insurance companies can tailor their protection to individual circumstances; and smart cities can interact with individual vehicles for a variety of reasons – eg optimised parking, reduced environmental impact and improved safety.

Or an environmental energy company needing to monitor and control a range of remotely located equipment such as solar farms and wind generators. At the same time, the company can equip site engineers with AR for repair and maintenance work and virtual reality (VR) for training and virtual meetings. This could all be provided securely and reliably using a virtual “slice” of a licensed network.

Or where users of unmodified smartphones can connect with “basestations in the sky” when out of cellular coverage, thereby providing safety and communication services irrespective of location. This will extend coverage from a mere 10% of the world’s surface, as now, to 100%.

Or an immersive gaming scenario such as a virtual car race involving multiple remotely located players where split-second timing is essential. For a truly immersive experience, add VR and AR functionality. This type of functionality could extend beyond games to training – for example a remotely located team conducting a medical procedure in a simulated operating theatre.

Or an “world education” provider where stduents can participate in a shared classroom style environment. This could extend to schools, universities and corporate training. And with VR/AR, could include virtual experiments and field-trips, all irrespective of the location of the teacher/trainer and the students.

These and countless other scenarios are possible with the most recent 5G specification, designated Release 17 by the 3GPP organisation responsible for defining 5G.

But 5G has been a disappointment so far

5G started to become available in 2020 and is now reasonably widespread. By far the main application is to provide telephony and mobile internet services to smartphones. 5G follows on from the highly successful 4G system which for the first time bought high data rates to smartphones for video, internet and a host of specialised services using phone apps.

The general reaction to 5G so far has been disappointment, partly because 4G already provides most of what is needed and partly because 5G coverage is patchy and, where available, data rates are not substantially better than with 4G – one recent study showed 5G is only 2.7 times faster than 4G. And there is no improvement in coverage relative to 4G.

One area where 5G has been applied successfully, especially in the US, is providing fixed wireless access (FWA) services to homes where fibre is not available. But in reality, this is an inefficient use of 5G and the associated spectrum. Revenue per bit is typically 30 to 50 times higher with mobile than fixed services meaning network operators are unlikely to pursue the FWA model on a large scale once more profitable alternatives become established.

Reasons why 5G services have not so far impressed consumers include a slower rollout than planned owing to the pandemic and, in some cases, spectrum shortages. In addition, some of the let-down is undoubtedly because of the usual over-hyping of the technology ahead of its introduction. More fundamentally, there is simply little demand for the higher data rates 5G can potentially offer. Research shows smartphone users are more concerned with features like battery life, camera performance, build quality and ease-of-use than they are about 5G and higher data rates.

Over time as more spectrum become available, the 5G experience for smartphone users will improve and as more users consume ever-greater quantities of data, 5G will be needed simply to keep up with demand. But this is not the case now and even when it is, several studies have shown smartphone users will not be prepared to pay more for 5G. So, we have a situation where network operators have to pay heavily for spectrum and network roll-out and yet there is no clear method to recover these costs. The situation is compounded since network operators are mostly shut-out of revenue streams from applications running on smartphones (see earlier Mobius insight). Such revenues mostly end up with the internet giants or specialist service providers.

As Mobius has observed several times previously, the real payoff for 5G will come from applications beyond conventional telecommunication services. Some progress has been made in this direction, but the economic impact remains limited. So, where does the new version of 5G (Release 17) fit into this picture?

New 5G release a game-changer

The 3GPP finalised Release 15, the first specification to include 5G, in June 2019. This defined a New Radio (NR) to replace the older 4G equivalent but retained the 4G core network operating behind the radio infrastructure. This so-called non-standalone version of 5G was extended in July 2020 with Release 16 which describes a full standalone 5G system including the core network. Progress on the next version of the specification, Release 17, was significantly delayed by the pandemic and is now scheduled to be completed in Q2 2022.

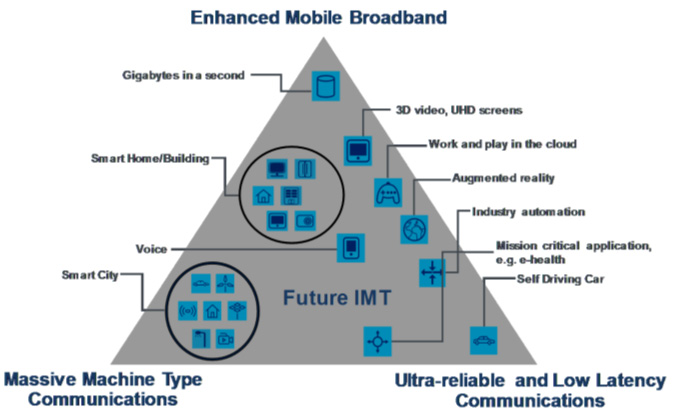

Before going into detail on Release 17, it is useful to review the key objective of 5G which are to provide:

- An enhanced mobile broadband (eMBB) with a peak data rate exceeding 10Gbps and user experienced rates above 100Mbps; 4G by contrast has a peak rate of 1Gbps

- More than 1 million connections per square km for massive machine-type communications (MMTC) – specifically the internet of things (IoT); this compares with around 10,000 connections per square km with 4G

- Less than 1ms latency for ultra-reliable low-latency communications (URLLC); the target here is applications such as self-driving cars and factory automation.

These features target a triangle of applications as illustrated below.

Source: ITU

Source: ITU

The focus in Release 15 and 16 was to get the basic 5G mechanisms working. The new Release 17 includes a range of enhancements and additions to the core system, but the really striking addition is the provision to extend 5G into new application domains, or industry verticals as 3GPP calls them. Such features are:

- Improvements to the sidelink capability which enables to devices to communicate directly with each other at high data rates and minimal latency. Sidelinks are ideal for peer-to-peer gaming, streaming services, connected road users and emergency services. They can also be used to improve applications involving AR, VR and wearable devices

- Improved support for reduced-capability (RedCap) devices. This feature enables cheaper and simpler devices in applications with wearables, industrial sensors and video surveillance

- Power saving and support for devices having low data rates and infrequent data transmission. The target here is battery-powered devices such as in smart meters and remote sensing applications

- Enhanced support for network slicing – the capability to create separate private networks in, for example, industrial applications and corporate networks

- Better positioning support – various mechanisms including the addition of position estimation not relying on satellite systems such GPS and mechanisms to estimate position with high accuracy (20-30cm) and low latency. Applications here are include remote-control and many factory automation tasks

- Enhanced ultra-reliable, low-latency communication, including in unlicensed applications. Targets here include factory automation, the transport industry and electrical power distribution

- Enhanced edge computing. This enables service providers to position functionality within or at the boundary of the network operator’s network. The target here is where high data rates and very low latency are required and where it is desired to reduce network loading. Typical examples include cloud applications and streaming

- Support for multicast and broadcast services – as required in applications such as digital education, over-the-air software updates, mission critical push-to-talk, live TV delivery and public safety applications

- The most ambitious new feature in Release 17 is its support for non-terrestrial network (NTN) applications. This feature is dealt with in separately in the next section.

As well as features in Release 17 supporting new applications, there are also enhancements providing more spectrum and more flexible ways of using it. This includes dynamic spectrum sharing, support for higher frequency operation (beyond 50GHz), support for unlicensed applications and enhanced beamforming and MIMO to improve spectral efficiency.

Beyond Release 17, 3GPP will progress to “5G Advanced” with Release 18 in the same way that “4G Advanced” followed on from basic 4G. And further into the future, 6G will probably make a first appearance in Release 21. But for now, Release 17 is a major step beyond telephony and smartphones into a hugely diverse range of new applications – see the illustration below.

Non-terrestrial Networks

Non-terrestrial Networks

Release 17 incudes for the first time support for non-terrestrial network (NTN) applications. This means extending 5G into applications involving high altitude platforms and, more importantly, satellites. It includes low-earth orbit (LEO) constellations, geostationary (GEO) satellites and intermediate orbits, thereby extending coverage to remote areas where terrestrial networks are not available and potentially to full global coverage. To start with, the main focus is expected to be in LEO applications where significant technical challenges need resolving including high doppler shifts, extended and viable time-delays and frequent connection changes between satellites as they move across the sky. Release 17 introduces methods to deal with these issues including pre-calculating and compensating for doppler and time delays based on knowledge of terminal location and the associated orbital mechanics.

Release 17 incudes for the first time support for non-terrestrial network (NTN) applications. This means extending 5G into applications involving high altitude platforms and, more importantly, satellites. It includes low-earth orbit (LEO) constellations, geostationary (GEO) satellites and intermediate orbits, thereby extending coverage to remote areas where terrestrial networks are not available and potentially to full global coverage. To start with, the main focus is expected to be in LEO applications where significant technical challenges need resolving including high doppler shifts, extended and viable time-delays and frequent connection changes between satellites as they move across the sky. Release 17 introduces methods to deal with these issues including pre-calculating and compensating for doppler and time delays based on knowledge of terminal location and the associated orbital mechanics.

The main alternatives for NTN in 5G are:

- The 5G basestation, or gNB, is located on the ground and the satellite provides transparent re-transmission, often called a “bent pipe”

- The so-called “basestation in the sky” or re-generative mode where most of the gNB functionality is located in the satellite; this mode may also support inter-satellite links. Full specification of this re-generative mode will take place in 3GPP Release 18

- Either of the two cases above with the addition of ground-based relay nodes or sidelinks to connect to end-user devices.

Three classes of applications for 5G-over-satellite can be discerned:

Internet-of-things (IoT) – Here the target is where communication is required to a large number of remote devices outside cellular coverage. Applications include farming, energy, transportation and logistics, utilities, infrastructure and maritime. An example of a provider in this area is the Spanish company Sateliot which is planning to use the 5G NB-IoT system

Other applications – Here the requirement is to communicate with special-purpose ground-based equipment other than in specific IoT case. Examples include communication to aircraft, ground-based cellular sites, freight, cars, public safety, VSATs, shipping and remotely located homes

Unmodified smartphones – A highly desirable, yet challenging, application is to extend 5G coverage to unmodified mobile smartphone terminals operating beyond the reach of terrestrial networks.

The reason the last of these classes is challenging is that beyond the features contained within Release 17 to address issues like high doppler shift, the path loss between smartphones and satellites is typically substantially higher than in normal terrestrial usage. For this reason, it seems likely initial provision will be limited to emergency services and perhaps messaging. More can be expected later, bringing a truly a new dimension to mobile networks.

For a time, there was a rumour that satellite capability would be included in the latest iPhone 13. This did not happen, at least in part since suitable satellite constellations are not yet in operation. However, it is expected to be included in future smartphones and will be supported by satellite constellations operated by companies such as AST SpaceMobile and Lynk. In the case of Lynk, a functioning service is planned to be available during 2022.

At SpaceMobile, the problem of high path loss is being addressed by deploying large phased-array antennas in their satellite constellation. The plan is to provide services to network operators on a wholesale basis making use of the operator’s own spectrum. Satellite-to-terminal connectivity will be supported in the range 600MHz to 2.2GHz. Satellite backhaul will operate at higher frequencies – V-Band has been mentioned. SpaceMobile has some heavyweight backers, including Vodafone, Rakuten and KKR.

In the past, mobile satellite communication providers such Iridium and Inmarsat have operated largely independently of terrestrial mobile networks. The exception is spectrum where terrestrial and satellite industries have competed strongly to retain existing allocations and gain access to new spectrum. This looks set to change now that 5G offers the capability to support both terrestrial and satellite domains. It is not yet clear what this means for existing satellite providers. However, given the undoubted weight behind 5G and the attractiveness of an integrated terrestrial/satellite solution, it seems certain 5G will play an increasing role.

Our view

5G is not needed right now to support smartphones which operate quite successfully using a combination of 4G and WiFi. But it will be needed over time to keep pace with ever-growing numbers of users and their demand for data. Advanced 5G features such as beamforming and support for new spectrum, especially in higher frequency bands beyond 5GHz, will provide the improvements needed. But experience shows end-users simply expect this form of ongoing evolution and are unwilling to pay extra for it.

Meanwhile, building and operating 5G networks is a costly business involving complications such as government limitations on which equipment manufacturers network operators can use and amid an ongoing trend towards open networks. The question therefore is where will the additional revenue needed for 5G to be a commercial success come from? The answer has to be the diversification of 5G into a whole host of new application areas.

Doing this will not be easy and one of the key issues is the industry structure. Experience of network operators exploiting applications beyond traditional telecommunications is mixed at best. They have the technical knowledge but are not sufficiently fleet-of-foot and do not understand the relevant industry verticals. In contrast, specialists in industry verticals such as factory automation do not understand the intricacies of a system as complex as 5G.

As well as the network operators and industry vertical specialists, there is a large and diverse group of others seeking a role. These include system integration companies, satellite operators, traditional network infrastructure companies, and government test-beds and research centres.

But none of these have the whole range of capabilities and experience required for new 5G applications and, in most cases, focus on a specific type of technology or solution. This can lead to limitations – for example, a licensed network operator is unlikely to offer a client a solution using unlicensed spectrum. Mobius Consultants has established a role here providing completely independent advice to clients based on a deep understanding of 5G and related technologies.

Our view is 5G will succeed in penetrating many new markets – the prize is simply too great for it to fail. But it won’t be easy and progress will be much faster in some areas than others. Our experience indicates the most attractive applications in the short term will be:

- Private enterprise networks. With 5G, enterprises like utilities and airlines can own a slice of a licensed network at reasonable cost meaning they get guaranteed quality of service

- Unlicensed operation. There are many use-cases where unlicensed operation is possible as an alternative to WiFi, especially where wider coverage is required such as in a city

- Connected vehicles. This is already a fast developing area driven by trends such as environmental pressures and the rise of electric and self-driving vehicles

- Factory automation and process industries. 5G will be a key component in a larger movement towards Industry 4.0

- The Internet of Things movement has progressed more slowly that originally envisaged. 5G will trigger a much larger scale uptake in all sorts of industries.

And finally, of all the new capabilities in Release 17, the most eye-catching is to harness satellite communications to extend mobile coverage from approximately 10% of the world’s surface (50% of the land mass) to 100%. Applications include agriculture, freight, renewable energy and many others. And, perhaps most exciting, the potential to connect globally to unmodified smartphones.